data

- in 2003, the debt was about $7.5 trillion in 2003 dollars. now it is around $9 trillion (in today's dollars). Wikipedia claims that at the end of 2006 it was about $5 trillion if "intragovernmental debt obligations" are subtacted. (sources: http://home.comcast.net/~andy_dunn/budget_main.html, http://www.cbsnews.com/stories/2007/09/06/notebook/main3238787.shtml, http://en.wikipedia.org/wiki/United_States_public_debt)

- according to http://www.bls.gov/cps/labor2006/chartbook.pdf, there were about 120,000,000 full-time employees in the U.S. in 2006. So, dividing $5 trillion by 120 million, we get about $42,000 debt per worker. So, one way to look at the debt is that it is as if everyone who has a job owes an extra $42,000 in income taxes that they have deferred.

- we've been running a deficit almost the whole time since 1969, except for a brief period of time in the end of the '90s (source: http://home.comcast.net/~andy_dunn/budget_main.html)

- this brief period of surplus DIDN'T MAKE A MUCH OF A DENT IN THE UNDERLYING DEBT:

- however, as a percentage of GDP debt has been roughly constant (around 60-65%) since 1990:

- looking at debt as a percentage of GDP there are other "respectable western countries" with a similar situation to us, for example Germany and France (https://www.cia.gov/library/publications/the-world-factbook/rankorder/2186rank.html)

- as a percentage of GDP, U.S. defence spending has been slowly declining over the long term:

- interest payments on the debt are about $200 billion/yr in 2003 dollars (according to Dunn; but according to treasurydirect.gov, they were $318 billion/yr in 2003 and were $406 billion/yr in 2006). For comparison, the NIH budget is about $30 billion/yr (i.e. the interest payments would have been enough to fund about 13 NIHs if we didn't have to pay interest) (sources: http://home.comcast.net/~andy_dunn/, http://www.treasurydirect.gov/govt/reports/ir/ir_expense.htm, http://officeofbudget.od.nih.gov/UI/..%5CFY06%5CAppropriation%20Summary%2006.pdf)

- GDP in 2006 was about $13 trillion, making the interest payments about 3% of GDP

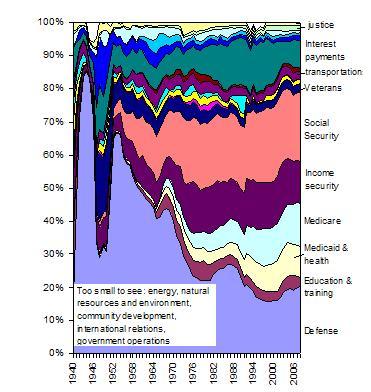

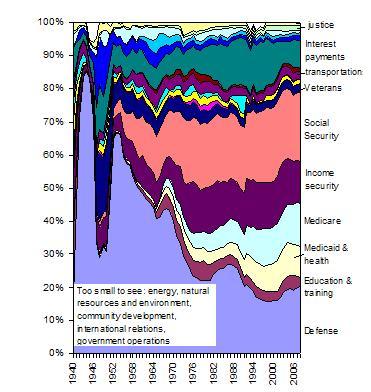

- the problem seems to be that we are spending too much on Social Security, Medicare, Medicaid, and "income security", and perhaps defence, although as noted above, in the long term defence spending has been falling relative to GDP (also, it's been falling as a proportion of the budget) (sources:

, http://www.peterlevine.ws/mt/archives/2007/02/the-federal-bud.html,

, http://www.peterlevine.ws/mt/archives/2007/02/the-federal-bud.html,  ). as peter levine puts it, "you cannot cut spending appreciably without touching defense, Social Security, Medicare, and Medicaid"

). as peter levine puts it, "you cannot cut spending appreciably without touching defense, Social Security, Medicare, and Medicaid" - by comparison, Ireland's national debt in 2006 was about 44 billion euros. The 2006 deficit was about 5 billion euros, and the 2006 interest payments were about 1.75 billion euros (I think; i'm not sure i read the spreadsheet correctly w/r/t the interest payments). The GDP was about 176 billion euros. So, in percents of GDP, Ireland's 2006 debt was about 25%, deficit was about 3%, and interest/yr was about 1%. (source: http://www.finance.gov.ie/documents/publications/other/maastrichtapr07rep.pdf)

![[Home]](http://www.bayleshanks.com/cartoonbayle.png)

, http://www.peterlevine.ws/mt/archives/2007/02/the-federal-bud.html,

, http://www.peterlevine.ws/mt/archives/2007/02/the-federal-bud.html,  ). as peter levine puts it, "you cannot cut spending appreciably without touching defense, Social Security, Medicare, and Medicaid"

). as peter levine puts it, "you cannot cut spending appreciably without touching defense, Social Security, Medicare, and Medicaid"